Risk Management

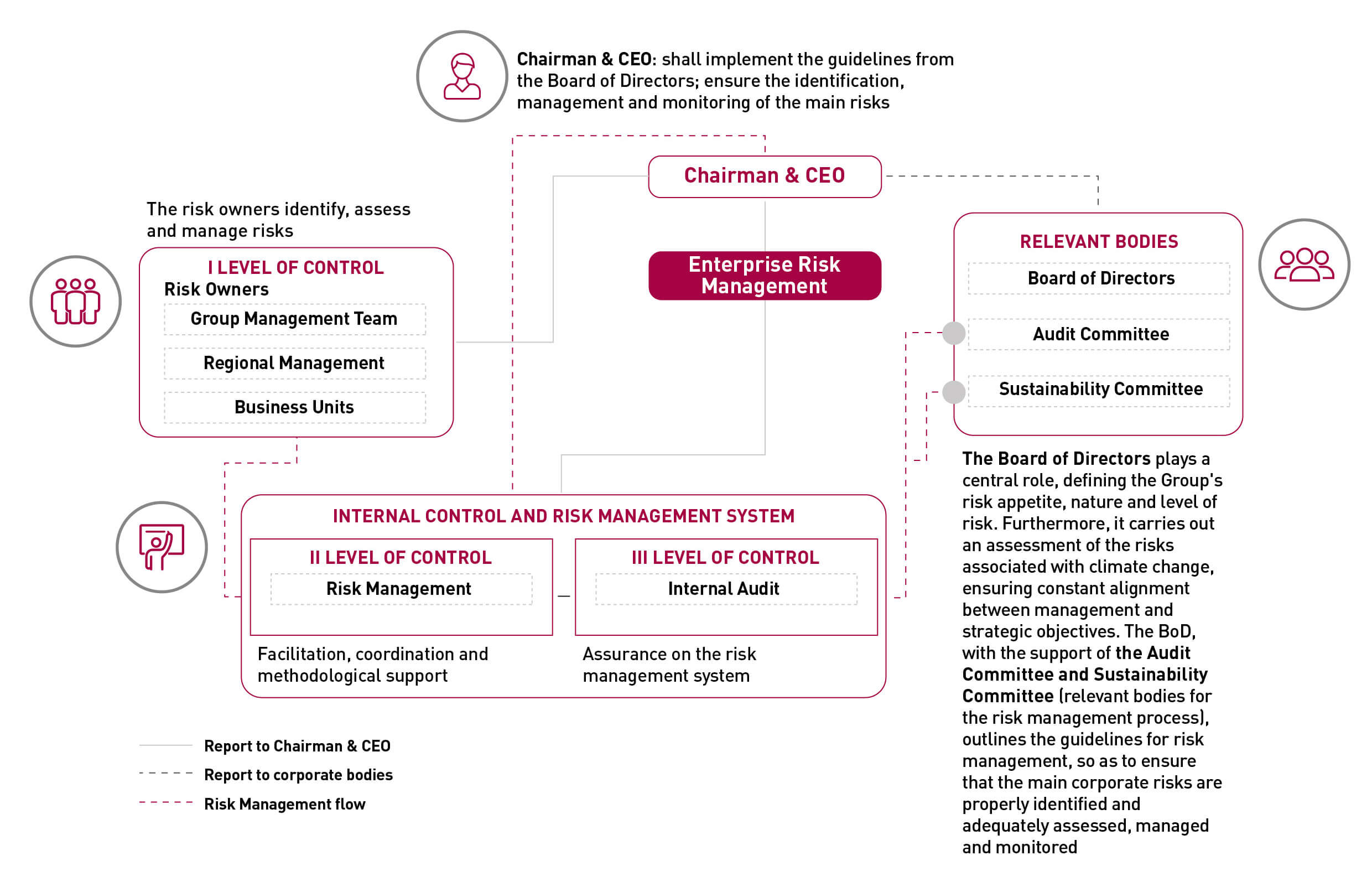

Enterprise Risk Management (ERM) is the Group's structure that supports management in identifying, assessing and monitoring risks, as well as defining the most effective response strategies for their mitigation.

The approach adopted by ERM is based on the principles envisaged by the Enterprise Risk Management – Integrated Framework, international standard issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO Report).

Risk management is an annual basis process that involves both the entire Corporate perimeter and a plurality of corporate functions.

The Risk Management Model is characterized by a structured approach, based on international best practices and considering the guidelines of the Internal Control and Risk Management System, which is structured on three control levels:

The Risk management process takes a top-down and risk-based approach, starting from the definition of Cementir's Industrial Plan. It ensures that major risks are identified, assessed, managed and monitored while taking into account the individual operations, risk profiles and risk management systems of each business unit, to create a wholly integrated risk management process. Risks are assessed with quantitative and qualitative tools considering both the probability of occurrence and the impacts that would be generated in a given time horizon if the risk were to occur. It also ensures that all necessary measures are taken to control risks that could threaten the Group's assets, its ability to generate profits or achieve its objectives.

At an operational level, the risk owners, through the support of the Risk Management function, identify the risks under their responsibility and provide an indication of the actions necessary to mitigate them. The results of this activity are subsequently consolidated in order to identify risks at the Group level, allowing an integrated management.

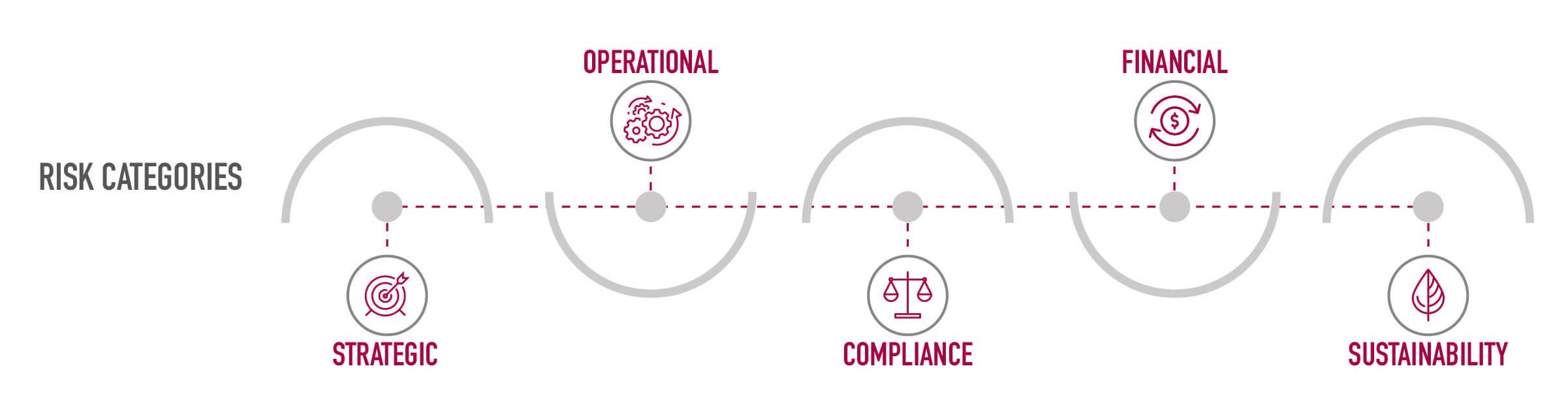

Risks are defined in a "Risk Library" divided into five macro categories:

This library is updated periodically: the latest update has included specific risks on climate change issues.

The Cementir Group's Internal Control and Risk Management System is integrated with the Group's Sustainability Strategy. Starting from 2021 the Cementir Group has launched a project to implement the recommendations of the TCFD (Task Force on Climate-Related Financial Disclosure) committing to be transparent on risks and opportunities related to climate change. The identification, assessment and effective management of risks and opportunities related to climate change are fully integrated into the Group's risk management process. To promote and improve its climate change disclosure, in 2022, the Group engaged Standard & Poor's (S&P) to assess physical and transitional climate risks and develop scenario analyses to support the implementation of the TCFD guidelines. The analysis carried out by S&P showed that the Cementir Group scored 100% on the overall assessment of the eleven recommendations of the TCFD, which represents a complete and transparent level of disclosure achieved. Furthermore, the Group is integrating the guidelines published by the European Union “EU Taxonomy Regulation”, which together with the TCFD constitute the reference frameworks.

MAIN RISKS TO WHICH THE GROUP IS EXPOSED

The main types of risks and opportunities to which the Group is exposed are described below.

STRATEGIC RISKS

-

Uncertain outlook

Description Impact Mitigation actions The Group's results are highly dependent on the economic conditions in the countries in which it operates:

- rising inflation and tightening monetary policy have made the outlook for global GDP growth weaker in 2023;

- the economic consequences of the war in Ukraine worsen the outlook for euro area economies, pushing inflationary pressures further upwards. GDP is expected to slow significantly in 2023, but to recover in 2024;

- estimates for American territory growth for 2023 have also been revised downwards;

- the recovery in China is being held back by the authorities' zero-COVID approach and the downturn in the real estate market, the contraction of which is expected to continue in 2023;

As for construction activity, the much higher cost of living combined with rising interest rates will hit the housing sector in most developed and emerging economies. Demand for building materials is fundamentally driven by economic growth. These changes in demand may affect sales volumes and prices.

The Group estimated a potential reduction in sales volumes

With the support of the relevant functions, the Group actively monitors market conditions in order to predict any adverse scenarios.

The Group aims to maintain strict cost discipline.

The Group will favour long-term contracts to ensure favourable logistics and energy costs.

-

Geopolitical risk

Description Impact Mitigation actions The Group operates on five continents and is exposed to political risks both locally and globally. Geopolitical instability in some of the countries where the Group operates may influence demand trends.

Impact on the Group's economic/financial results

The Group continuously monitors the reference environment, focusing mainly on political/institutional developments and regulatory aspects that may potentially affect operations. Geographical differentiation, on the other hand, helps the Group limit its exposure to this risk.

FINANCIAL RISK

-

Devaluation of the Turkish lira

Description Impact Mitigation actions The Group operates in ten different currencies and exchange rate fluctuations can affect the economic/financial situation of the Group. The Turkish lira is the currency mainly affected by a significant depreciation in recent years. The main indicators show an increase in the CPI (Consumer Price Index) of about 104% (compared to 2003 data) and the PPI (Producer Price Index) which reached 151% at the end of September (compared to 2003 data). The Central Bank of Türkiye continues to cut interest rates despite high inflation. Under these conditions, the Turkish lira could continue to be devalued against the two main currencies: € and $. In addition, the presidential and parliamentary elections, scheduled for June 2023, could cause further uncertainty regarding the actions that Turkish financial institutions could take.

Unfavourable exchange rate changes could adversely affect Group profits The Group continuously monitors currencies in order to reduce overall exposure and seize opportunities through hedging operations.

OPERATIONAL RISKS

-

Raw material (fuel and electricity) price volatility

Description Impact Mitigation actions Risk linked to the volatility of commodities market prices (electricity and fuel), which may affect the Group's results.

The war in Ukraine is having a significant impact on raw material prices. Sanctions against Russia in the energy sectors and Europe's dependence on Russian supplies have already contributed to a sharp increase in gas and oil prices, which has increased costs for the company.

The Group closely monitors energy market trends and stocks of goods needed for production and continuously seeks the best supply conditions to meet production needs. These risks are overseen by each Local Procurement with the coordination of the Corporate Global Procurement, which uses financial instruments commonly available on the market in order to keep risk exposure within set limits.

Operational costs increase The Group contains price risks for energy and fuels by centralising supply management.

In order to reduce the risk of price volatility, it uses financial instruments such as hedging, signs sales contracts based on indexed formulas, enters into long-term contracts with suppliers, and is expanding the use of alternative energy sources including gas or green energy.

-

Logistics and freight costs

Description Impact Mitigation actions Logistics costs (road transport)

Logistics is one of the key drivers of the Group's business. The recent conflict in Ukraine has had a significant impact on rising fuel prices and thereby on logistical costs. This trend is expected to continue throughout 2023.Freight costs (shipping transport)

The Group is exposed to volatile freight costs due to the uncertainty of macroeconomic conditions (recession and high inflation).Operational costs increase Logistic costs:

The Group is establishing agreements with a ceiling in order to reduce the impact of increases proposed by carriers.For expiring contracts, the Group is launching tender activities to select the best option.

Transport costs:

For specific shipping routes such as Europe versus USA or Türkiye versus Belgium and Denmark, the Group is signing AOC (Contract of Affreightment) agreements. -

Cyber security

Description Impact Mitigation actions The increasing use of IT systems increases the Company's exposure to various types of risks. The most significant is the risk of cyber-attacks which is a constant threat to the Group.

Data loss

Privacy impacts

Business interruption

Reputational damage

- Strengthening of network infrastructure;

- Strengthening of protection systems;

- Constant updating of internal procedures;

- Continuous training for all staff to strengthen the corporate culture on cyber security issues.

-

Risk of the Covid-19 pandemic

Description Impact Mitigation actions Cementir sells its products all over the world and has plants in several countries. The pandemic and the measures put in place to mitigate the effect of the virus by some government authorities have been relaxed over the past year with the exception of a few countries (e.g. China). These risks from new variants, if they persist, could alter normal market dynamics and business operating conditions. For example, China’s ZERO-COVID policy, aimed at zero contagion, has led to a slowdown in production activities, a contraction in the construction sector and a drop in turnover.

Impact on operations, and Group results

The Company has promptly adopted control and prevention measures for all employees around the world, including through alternative (remote) working methods, both for offices and operational sites.

Ensure business continuity according to government guidelines.

-

Talent and retention management

Description Impact Mitigation actions Existing processes related to “people management”, such as attracting, retaining and developing staff members, succession planning, as well as the focus on developing a diverse and inclusive workforce, contribute significantly to the realisation of corporate strategies. Failure to attract talent could hinder the achievement of strategic objectives. The Group promotes its image with new talent and all employees through specific actions, such as international mobility and career development campaigns, for example the Talent Program and Cementorship Graduate Program initiatives launched in 2022 and continuing in 2023.

In November 2022, the Global Survey “Your Voice” was also launched with the aim of collecting feedback from all staff on the working environment and areas for improvement.

COMPLIANCE RISKS

-

Health and safety

Description Impact Mitigation actions Risk of accidents that can have consequences for the health of workers and / or cause problems in production processes.

Impacts:

- Economic

- Organisational

- Reputational

- Relations with local communities

- Workers' health

Improvement of the Group's safety culture by sharing best practices and common rules across the Group (e.g. Golden Rules).

Regular risk assessment by all plants to eliminate/mitigate risks (annual action plans).

Group monitoring of H&S performance and effectiveness of corrective measures.

Periodic verification of the effectiveness of the main H&S processes for all plants (e.g. work permits, incident management, etc.).

-

Compliance

Description Impact Mitigation actions These are risks related to compliance with applicable regulations (antitrust, anti-corruption, GDPR, Legislative Decree 231/2001).

Potential violations of laws and regulations

In relation to these risks, the Legal Department implements targeted programs with guidelines, procedures and training to ensure compliance with the above regulations. The Organisation and Control Models required under Legislative Decree 231/2001 are periodically updated.

The Internal Audit function carries out specific audits on compliance with regulations.

CLIMATE CHANGE

The cement industry's ability to reduce its CO2 emissions and respond to climate change has become a focal point for investors. In 2021, the Cementir Group has launched a project to implement the recommendations of the TCFD (Task Force on Climate-Related Financial Disclosure) committing to be transparent on risks and opportunities related to climate change. Cementir is also committed to ensuring the transparency of its climate-related risks and opportunities in line with the taxonomy required by the European Union. The identification, assessment and effective management of risks and opportunities related to climate change are fully integrated into the Group's risk management process.

As suggested by the TCFD, the Group monitors the risks and opportunities arising from the evolution of transition scenarios and the evolution of physical variables.

Physical variables are divided into two categories of risk:

- Acute: related to the occurrence of extreme weather conditions such as cyclones, hurricanes or floods. Acute physical phenomena, in the various cases, are characterised by considerable intensity and a frequency of occurrence that is not high in the short term, but which, considering long-term scenarios, sees a clear upward trend;

- Chronic: refers to gradual and long-term changes in climate patterns (e.g., sustained high temperatures) that can cause sea-level rises or chronic heat waves.

With regard to the energy transition process, towards a progressive reduction of carbon emissions, there are risks and opportunities linked to changes in the regulatory, technological, market and reputational context.

The Group has decided to align itself to the TCFD framework to clearly represent the types of risks and opportunities by indicating how each of them should be managed. The effects were assessed over three time horizons: the short term (1-3 years), linked to the implementation of the Industrial Plan; the medium term until 2030, in which it will be possible to see the effects of the energy transition; the long term until 2050, by which the Group is committed to achieving net-zero emissions throughout its value chain. As the TCFD states, the process of disclosing risks and opportunities related to climate change will be gradual and incremental from year to year.

-

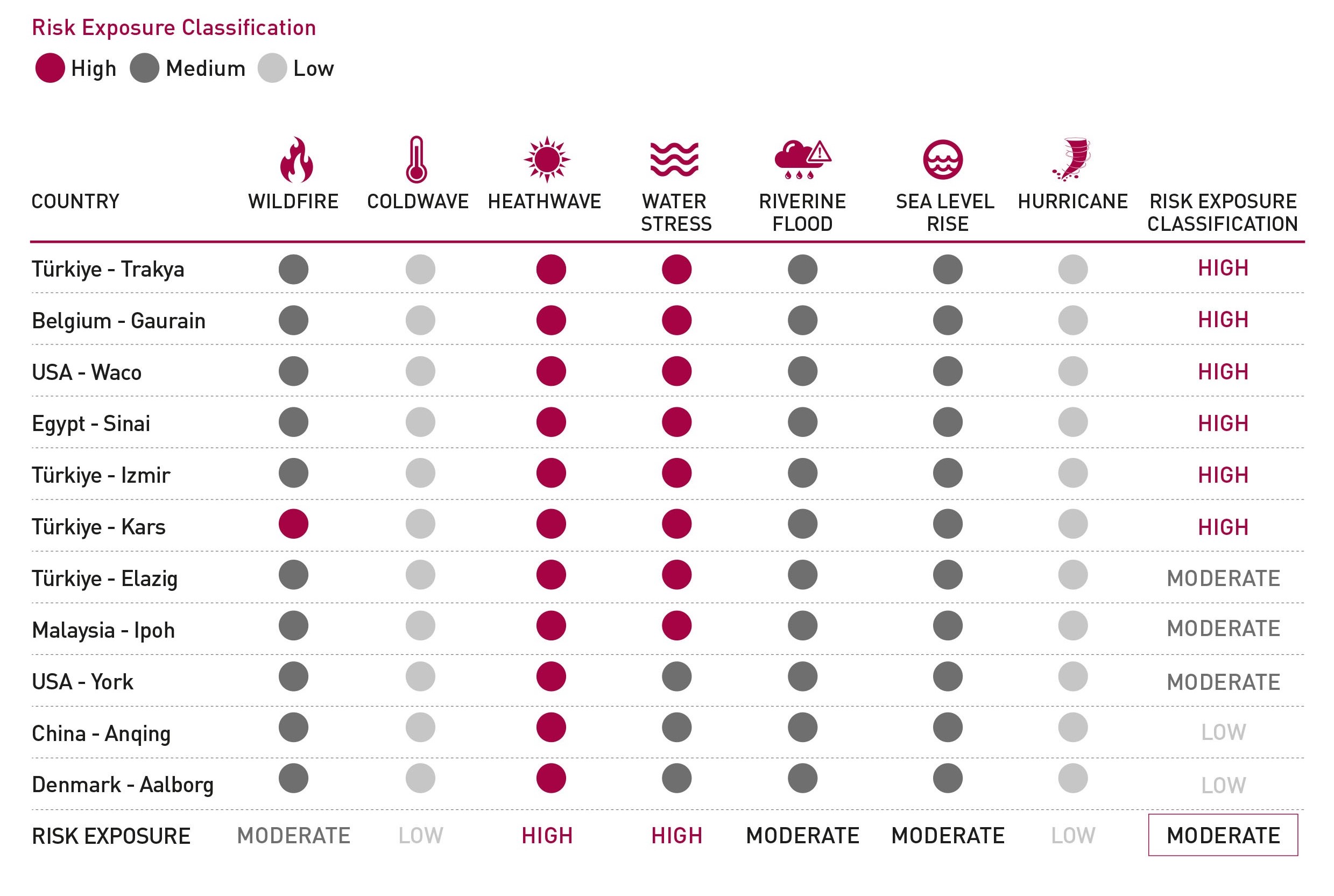

Chronic and acute physical phenomena

The Group’s plants are located in locations with overall moderate levels of physical risk over the time horizon to 2050, as shown in the following table.

Strategically, the Group’s geographical diversification provides a high degree of resilience. The Group adopts business continuity management processes that ensure an adequate level of maintenance in order to limit and/or reduce damage to corporate assets and ensures the resilience of the business and the restoration of operations in the event of force majeure events.

In some areas (Belgium, Türkiye, Egypt) there is also significant exposure to water stress.

CHRONIC RISK Time horizon Description Impact Mitigation actions SDG's Medium Term Water stress due to global warming

The Group operates in certain areas defined as under high water stress, with the risk of increased supply costs.

As part of its climate commitments, the Group has defined its policy on water management. Maximising its reuse/recycling, minimising withdrawals and consumption and applying efficient operating practices are areas of focus, starting with those geographical areas with the greatest water scarcity. The Group has set overall reduction targets of 20% in specific water consumption for cement production by 2030 and 25% in areas with increased water stress.

-

Transition risks and related opportunities

In recent years, the whole Group has been actively engaged in pursuing a transition to a low-carbon economy by defining a 10-year Roadmap. Related risks and opportunities are presented in the following table:

TECHNOLOGY Time horizon Description Impact Mitigation actions SDG's Medium – Long Term OPPORTUNITY

Carbon Capture “CCS”

The implementation of this innovative technology will be a keystone on the path to "net zero emissions" cement production.

The development and implementation of CCS technology will lead the company to achieve its goals of reducing CO2 emissions. The Group is considering several opportunities, mainly in Denmark and Belgium.

Continued support for research and innovation for the development of CCS and the use of CAPEX/OPEX for the full industrialisation of these technologies.

REPUTATION Time horizon Description Impact Mitigation actions SDG's Short Term RISK

Reputational risk

The risk of being perceived by the public as a major carbon emitter could reduce the Group's attractiveness to stakeholders. The risk is mitigated by the Group’s Sustainability Strategy, whose emission reduction targets have been validated by SBTi (well below 2°). In Denmark, the new Roadmap has been published with ambitious scope 1 and scope 2 emissions targets (70% reduction in CO2 emissions by 2030).

Cementir's ambition is to reduce CO₂ emissions intensity to achieve carbon neutrality along the value chain by 2050.

POLICY & REGULATION Time horizon Description Impact Mitigation actions SDG's Medium – Long Term RISK

Exposure to new CO2 emissions laws and regulations

Following the Paris Climate Agreement (COP21), signatory countries are required to commit to an emission reduction path. The likely effect will be an increasing number of CO2 regulations that will increase the cost of emissions.

The speed and level at which carbon prices could rise are uncertain and will vary between countries and regions.

The risk was assessed by S&P through different pricing scenarios applied in each country in which the Group operates and based on the introduction of CCS technology from 2030.

The Group minimises its exposure to the risk of new taxes and regulations through the progressive decarbonisation process. Cementir's ambition is to reduce CO₂ emissions intensity to achieve carbon neutrality along the value chain by 2050.

The strategy focused on energy transition makes the Group resilient to the risk associated with introducing more ambitious emission reduction policies and maximises opportunities for infrastructure and technology development.

POLICY & REGULATION Time horizon Description Impact Mitigation actions SDG's Medium – Long Term RISK

OPPORTUNITY

CBAM – Carbon Border Adjustment Mechanism and ETS reports

Initiatives such as the CBAM "Carbon Border Adjustment Mechanism" are designed to protect the competitiveness of the European Union. On the other hand, the introduction of this tax could change the business model for import activities from regions with less stringent CO2 regulations. In recent years, the quantities of cement imported into Europe have increased compared to the past.

European bodies are considering introducing this tax from 2026.

Monitoring of international bodies (European Union, FSB – Financial Stability Board, Government Authorities)

MARKET Time horizon Description Impact Mitigations action SDG's Medium Term RISK

Availability of raw materials

The production of cement and ready-mixed concrete requires the use of raw materials such as clay, fly ash and blast furnace slag (the latter two areby- products respectively of coal-fired power stations and steelworks whose production is to be reduced). During 2022, following the conflict between Russia and Ukraine, to avoid power shortages, authorities reopened coal-fired power plants, which is leading to increased availability of fly ash in the short term (2023 and 2024).

In the medium term (from 2025), fly ash may be in short supply again in Europe as coal-fired plants are phased out.

A further strategic material for achieving the Group's objectives is the calcined clay required for the production of Futurecem and for the reduction of the clinker ratio.

In order to reduce the shortage of these materials, the Group is securing its supply through long-term contracts; search for new suppliers and partial replacement of fly ash with similar materials available on the market (e.g. oxytone).

MARKET Time horizon Description Impact Mitigations action SDG's Medium Term RISK

Increased costs of using alternative fuels and lower availability

The achievement of CO₂ reduction targets is also achieved through the use of biomass (i.e. meat and bone meal, sawdust, seeds).

In current market conditions, quantities of these alternative fuels are shrinking due to increasing demand, and supply costs are rising as suppliers begin to demand a price indexed to production costs.

Identification of partnerships with other suppliers in order to increase flexibility in the supply chain.

MARKET Time horizon Description Impact Mitigation actions SDG's Short – Medium term

Development of low emission impact products

Innovation is a key factor in the long-term success of the company developing low-carbon products. To meet market demand, Cementir Group has developed new types of Cement (e.g. FUTURECEM) that reduce CO2 emissions by 30% compared to traditional cement.

The Group meets the needs of customers along the value chain by developing and delivering products, solutions and technologies that address the key challenges facing the construction industry.

The Group continuously develops and introduces new low emission products: increasing the use of decarbonised material (e.g. blast furnace slag); producing limestone cement or cement using fly ash;

In addition, the Group aims to reduce the clinker ratio by using FUTURECEM and other new products.

RESOURCE EFFICIENCY Time horizon Description Impact Mitigation actions SDG's Short – Medium term

Recovery and purification of water used in quarry operations

Under the coordination of the Walloon Region, the Group participated in the project to make groundwater from the Clypot quarry drinkable and make it available to the public network. In September 2022, a similar project was signed with SWDE (Wallonia Water Management Company) for the Gaurain quarry, with the start of drinking water supplies from 2024.

Increase in the amount of water delivered to the public network from the Clypot quarry (up to 3,500,000 cubic metres per year).

New water supplies from the Gaurain site to the public network from 2024. (up to 1,700,000m3 per year);

Development of partnerships with local communities.

ENERGY SOURCE Time horizon Description Impact Mitigation actions SDG's Medium – Long Term OPPORTUNITY

Green Energy

As part of the Group's strategy to reduce Scope 2 emissions, it is planned to increase electricity from renewable sources, either by purchasing or producing it internally. The Group is assessing the feasibility of wind turbine and solar panel projects.

Definition of a roadmap to increase the use of renewable energy throughout the Group, entering into purchase and/or own production agreements (for example solar panels or wind turbines).

ENERGY SOURCE Time horizon Description Impact Mitigation actions SDG's Short – Medium term

OPPORTUNITY

Increased supply of district heating in the city of Aalborg

The Aalborg plant recovers excess heat from cement production to provide district heating to local residents. In 2021, Aalborg Portland delivered approximately 1.7 million GJ of energy to the municipality of Aalborg. According to the engineering project developed by the Group, the Aalborg plant could improve energy supply by a further one million GJ reaching 50,000 households.

Negotiations are ongoing with the municipality of Aalborg to define the size and increase of the capacity of the heating supply.